In this week’s recap: stocks move lower as traders again absorb conflicting messages about trade talks; the Federal Reserve shares its October meeting minutes; good news comes from the housing market.

Weekly Market Commentary |Presented by Sterling Wealth Advisors | November 25, 2019

THE WEEK ON WALL STREET

Stocks declined last week as mixed signals emerged about the progress of U.S.-China trade negotiations.

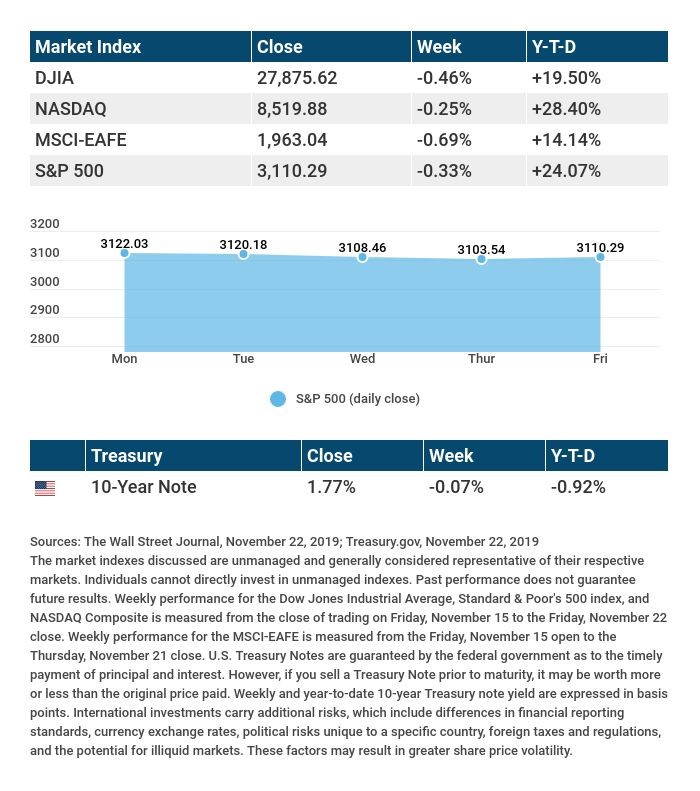

The three major Wall Street benchmarks all took weekly losses. The Dow Jones Industrial Average declined 0.46%; the S&P 500, 0.33%; the Nasdaq Composite, 0.25%. Also pulling back, the MSCI EAFE index, tracking developed stock markets outside the U.S. and Canada, retreated 0.69%.1,2

Nothing Conclusive Regarding Trade

As the market week ended, there was still haziness surrounding the state of U.S.-China trade discussions. Were negotiators on the cusp of a phase-one deal or further away?

Friday, President Trump told reporters that a deal was “very close,” but Chinese President Xi Jinping said that his country could decide to “fight back” against certain terms. Last week, a bill intended to support Hong Kong protesters advanced through Congress, and that development was not taken well in Beijing.3,4

The Fed Assesses the Economy

Federal Reserve officials gathered for their October meeting “generally saw the economic outlook as positive,” according to minutes from the central bank’s October monetary policy meeting released Wednesday. Some of them termed the economy “resilient.”

The minutes also noted that the Fed would wait to assess the impact of its recent interest rate cuts and that any upcoming policy decisions might be data dependent.5

Strength in the Housing Sector

Existing home sales improved 1.9% last month, by the estimation of the National Association of Realtors. Year-over-year, sales were up 4.6% through October, and the median sale price was $270,900, 6.2% above where it was 12 months earlier.

Wednesday, the Census Bureau said that single-family home construction increased for a fifth straight month in October. In addition, the pace of building permits for new homes hit a level unseen since 2007.6,7

What’s Ahead

This will be an abbreviated trading week on Wall Street. U.S. stock and bond markets are closed on Thanksgiving Day (Thursday) and then reopen for a half-day session on Friday.

TIP OF THE WEEK

Looking to save a little money while traveling during the holiday season? See if you can take just a carry-on or one checked bag to cut down on baggage fees.

THE WEEK AHEAD: KEY ECONOMIC DATA

Tuesday: The Census Bureau issues its latest new home sales snapshot, and the Conference Board releases its November Consumer Confidence Index.

Wednesday: October consumer spending numbers appear from the Department of Commerce, and the Bureau of Economic Analysis publishes a new estimate of third-quarter economic expansion.

Source: Econoday, November 22, 2019

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

THE WEEK AHEAD: COMPANIES REPORTING EARNINGS

Monday: Agilent (A), Hewlett-Packard (HPE), Palo Alto Networks (PANW)

Tuesday: Analog Devices (ADI), Dell Technologies (DELL), Vmware (VMW)

Wednesday: Deere & Co. (DE)

Source: Zacks.com, November 22, 2019

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

QUOTE OF THE WEEK

“The bravest thing you can do when you are not brave is to profess courage and act accordingly.”

CORA HARRIS

THE WEEKLY RIDDLE

Two children are born in the same hospital, on the same year, on the same day, and have the same father and mother… but they are not twins. How is this possible?

LAST WEEK’S RIDDLE: I give light by night, but not by day. Wicked I am, but not evil in any way. I mostly wax, but always wane. Except when I’m out, I stay the same. What am I?

ANSWER: A candle.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Wealth Advisors and Cambridge are not affiliated.

To learn more about Sterling Wealth Advisors, visit us on the web at www.sterlingwealthadvisorstx.com

Know someone who could use information like this?

Please feel free send us their contact information via phone or email. (Don’t worry – we’ll

request their permission before adding them to our mailing list.)

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding a ny Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economi c instability and differences in accounting standards. This material represents an assessment of the market environment at a specif ic point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any p erson or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

CITATIONS:

1 – wsj.com/market-data [11/22/19]

2 – quotes.wsj.com/index/XX/990300/historical-prices [11/22/19]

3 – cnbc.com/2019/11/22/dow-futures-amid-us-china-trade-uncertainty.html [11/22/19]

4 – cnbc.com/2019/11/22/hong-kong-rights-bill-unlikely-to-derail-us-china-trade-talks.html [11/22/19]

5 – marketwatch.com/story/fed-minutes-show-worries-about-economy-had-eased-a-bit-2019-11-20 [11/20/19]

6 – inman.com/2019/11/21/existing-home-sales-pick-up-in-october-after-slump-nar/ [11/21/19]

7 – marketwatch.com/story/permits-for-new-home-construction-hits-post-recession-record-high-in-october-2019-11-19 [11/19/19]

CHART CITATIONS:

wsj.com/market-data [11/22/19]

quotes.wsj.com/index/XX/990300/historical-prices [11/22/19]

quotes.wsj.com/index/SPX/historical-prices [11/22/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield [11/22/19]

treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yieldAll [11/22/19]