In this week’s recap: Coronavirus continues to drive the markets, even as bankers and health professionals take decisive steps to stem the tide.

Weekly Market Commentary |Presented by Sterling Wealth Advisors |March 23, 2020

The stock market suffered through another volatile week as it wrestled with the health and economic fallout of the domestic spread of the coronavirus. Swift and decisive actions by the Federal Reserve and policy responses from the federal government did not keep stocks from recording losses for the week.

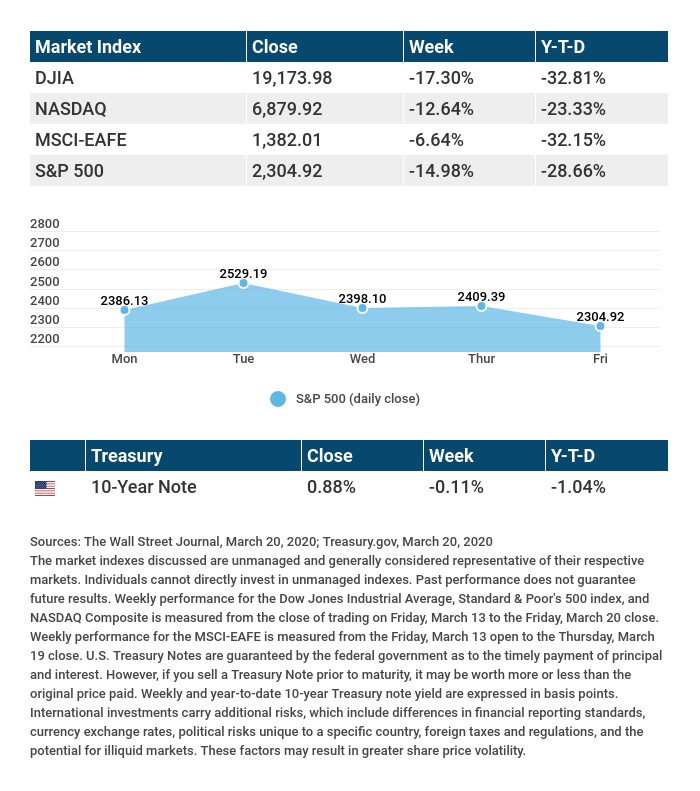

The Dow Jones Industrial Average slumped 17.3%, while the Standard & Poor 500 lost 14.98%. The Nasdaq Composite index declined 12.64% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 6.64%.1-3

Stocks Slide Further

The stock market continued its retreat amid fears of a darkening economic impact from the coronavirus pandemic. Despite a Sunday night announcement by the Federal Reserve that it was cutting its benchmark interest rate by 100 basis points to nearly zero and taking steps to increase market liquidity, stocks opened the week sharply lower, setting the stage for another difficult week for investors.4

Progress was reported on coronavirus testing capacity and on the efforts to combat the infection. At the same time, Washington, D.C., advanced legislation to provide financial assistance to unemployed workers and affected businesses. Neither did much to help investor anxieties, however. Stocks slid in the closing hours of the trading week, leaving stock indices near their lows of the week.5

Central Bankers Go Big

The response of global central bankers to mitigate the economic impact of the coronavirus has been broad ranging. In addition to its 100 basis point cut in the federal funds rate, the Federal Reserve also took actions to provide additional credit access to banks, committed to buy at least $700 billion in Treasury and mortgage bonds, and set up a new lending facility to backstop money market funds.6

The European Central Bank also announced an $800 billion-plus bond buying program to support member economies. The Bank of England cut its benchmark lending rate to 0.1% and pledged to buy over $200 billion in government and investment grade corporate bonds, while the Bank of Japan said that it would double its purchases of stocks and increase loans to businesses.7-9

Final Thought

Investors are struggling with answers to two unknowns: the trajectory of the coronavirus spread and its economic cost. With coronavirus testing beginning to ramp up, these numbers may begin drawing a firmer picture of the growth of coronavirus infections in the U.S. Economic indicators, such as jobless claims for unemployment insurance and the Index of Leading Economic Indicators, may provide clues regarding the economy.

TIP OF THE WEEK

Federal student loans may offer 6-month grace periods before any repayment is necessary, but having an income-based repayment plan in place soon after graduation is wise. Repayments can be limited to affordable amounts through these plans.

Tuesday: New Home Sales.

Wednesday: Durable Goods Orders.

Thursday: 4th-quarter GDP (Gross Domestic Product) Report. Jobless Claims for Unemployment.

Friday: Consumer Sentiment.

Source: Econoday, March 20, 2020

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

QUOTE OF THE WEEK

“I’d take the awe of understanding over the awe of ignorance any day.”

DOUGLAS ADAMS

THE WEEKLY RIDDLE

A man pocketed it and took it home, intending to eat it. He put it on a shelf, but three days later, it walked away. What was it?

LAST WEEK’S RIDDLE: What can fill a room, yet takes up no physical space?

ANSWER: Light.

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Advisory services offered through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Sterling Wealth Advisors and Cambridge are not affiliated.

To learn more about Sterling Wealth Advisors, visit us on the web at www.sterlingwealthadvisorstx.com

Know someone who could use information like this? Please feel free send us their contact information via phone or email. (Don’t worry – we’ll request their permission before adding them to our mailing list.)

1 – The Wall Street Journal, March 20, 2020

2 – The Wall Street Journal, March 20, 2020

3 – The Wall Street Journal, March 20, 2020

4 – CNBC.com, March 15, 2020

5 – CNBC.com, March 20, 2020

6 – The Wall Street Journal, March 19, 2020

7 – CNBC.com, March 19, 2020

8 – Pension & Investments, March 19, 2020

9 – Financial Times, March 16, 2020

CHART CITATIONS:

The Wall Street Journal, March 20, 2020

The Wall Street Journal, March 20, 2020

Treasury.gov, March 20, 2020